Fed rate hike

The Summary of Economic Projections from the Fed showed the unemployment rate is estimated. 15 hours agoOn Wednesday the Federal Reserve raised rates again marking the sixth rate hike of 2022.

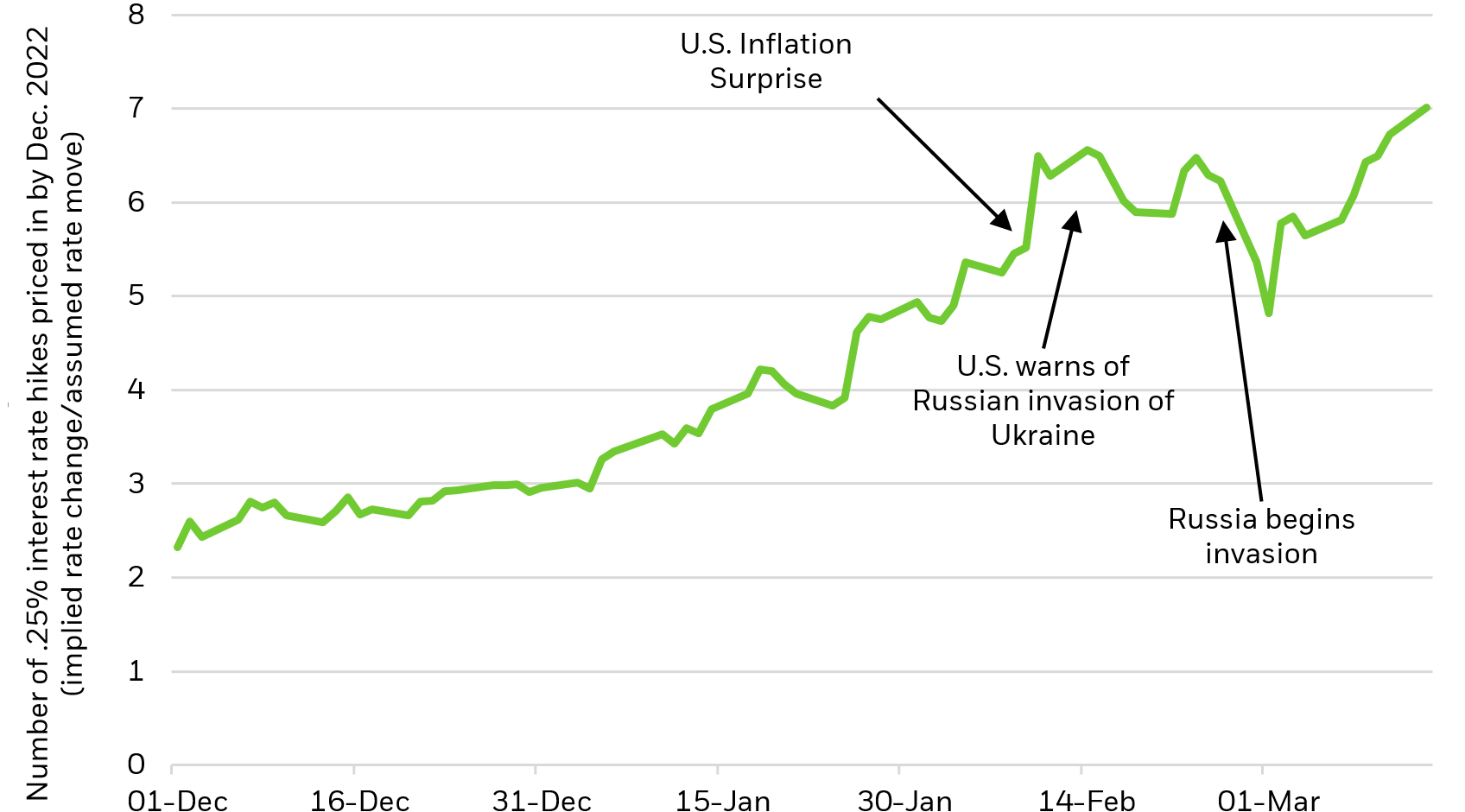

Rate Hikes The Fed Won T Hike Nearly As Much As Expected Real Investment Advice Commentaries Advisor Perspectives

This move was in response to Septembers inflation data which reported an 82.

. What rate hikes cost you. Fed latest rate hike. 16 hours agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

In September the Federal Reserve raised rates by 75 basis points marking the fifth rate hike of the year. 23 hours agoStocks rose shortly after the Federal Reserve rate hike announcement was released at 2 pm ET. The Fed emphasized its awareness of.

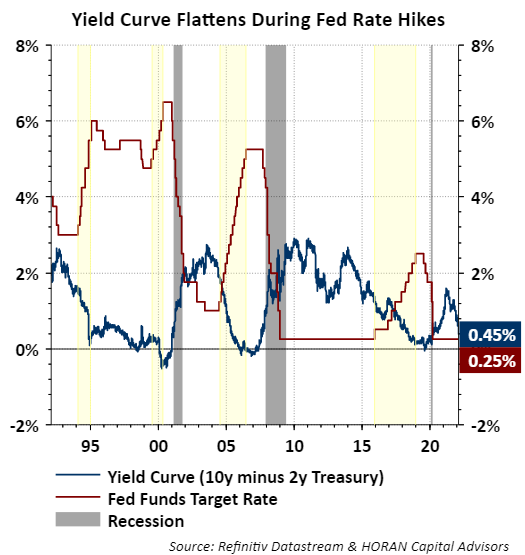

The big question is what happens next. Rate hikes are associated with the peak of the economic cycle. 075 to 100.

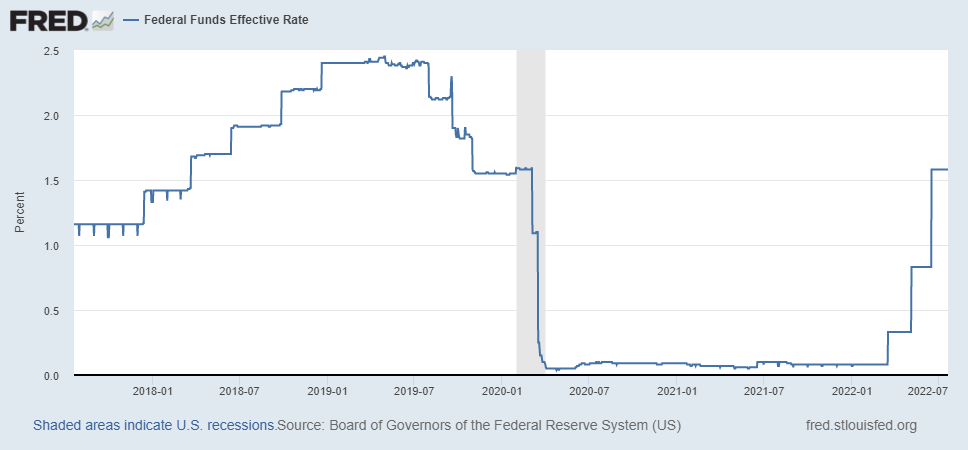

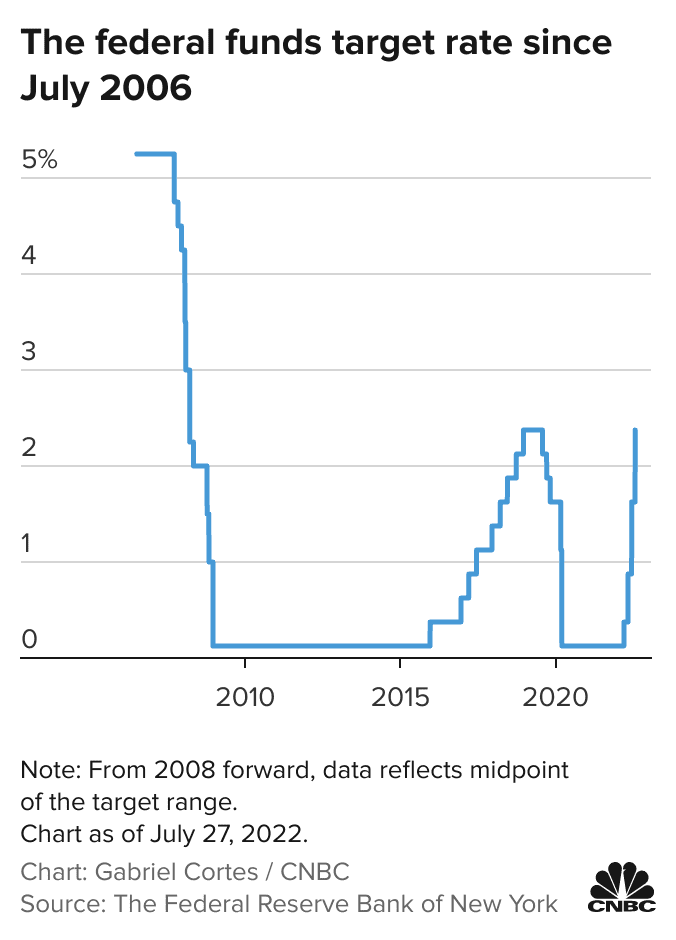

Traders are pricing in a more than 95 chance of another 75 basis point hike at the conclusion of the Feds two-day meeting Nov. Its easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt. The central bank has been bedeviled by. At the time the Fed indicated that it was unlikely to be the last rate.

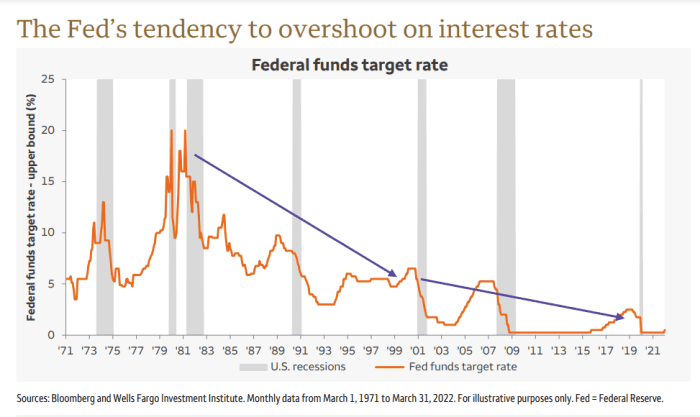

Besides during the early 1990s the Fed mainly adjusted rates at Federal Open Market Committee FOMC meetings a practice that is in rhythm with todays Fed. The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

During his post-meeting conference Fed Chair Jerome Powell. 2 according to the CME Groups FedWatch tool. Recession risks are growing but the Federal Reserve is sticking with aggressive interest rate increases for now.

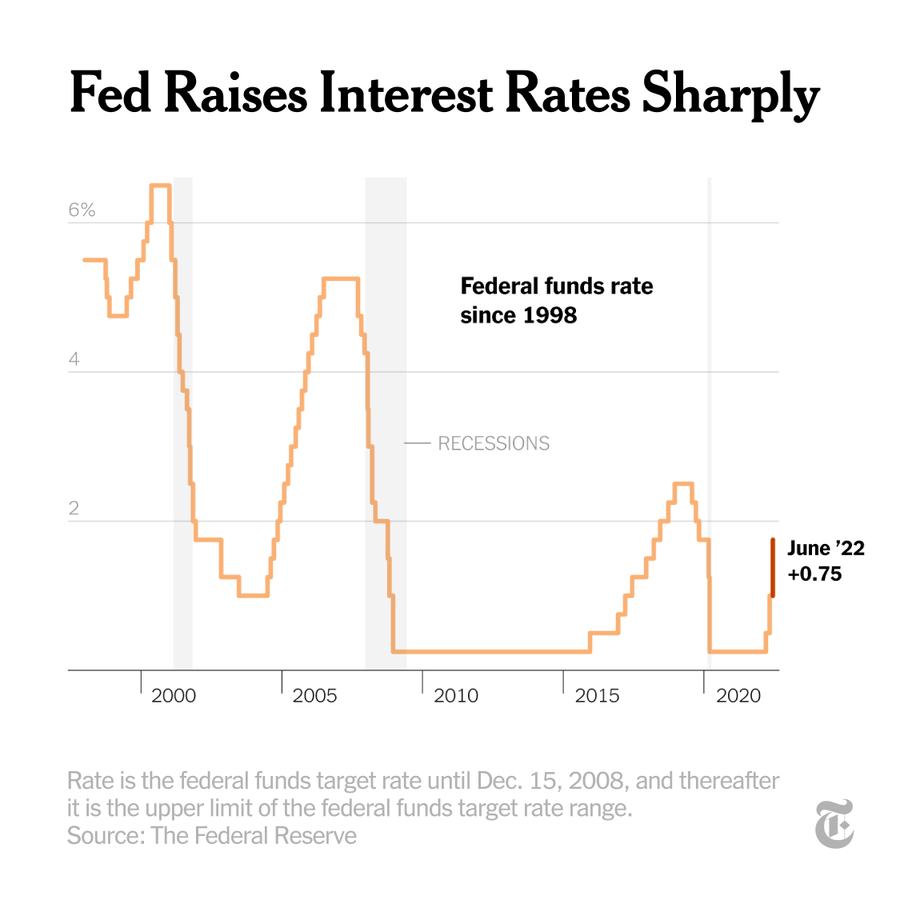

1 day agoFed poised to hike rates by 075 percentage points for fourth time. How will it affect mortgages credit cards and auto loans. 13 hours agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

That implies a quarter-point rate rise next year but. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. The series of big rate hikes are expected to slow down the economy.

The Fed and Wall Street should have called it a day at 201. 1 day agoThe Federal Reserve raised interest rates by another 075 percentage points Wednesday as part of its ongoing effort to fight inflation. The latest increase moved the.

Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. 16 hours agoThe Federal Reserve will likely go for smaller interest rate hikes after its latess 075 percentage point rate increase according to Peter Boockvar chief investment officer at. The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point.

The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018.

With Federal Reserve Poised For Another 75 Bp Rate Hike What S Next Seeking Alpha

How Will Fed Rate Hikes Affect The Investment Landscape

Fed Rate Hikes And Recessions Horan

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Why A Federal Reserve Interest Rate Hike Could Help To Lower Inflation As Usa

Maneuvering Through The Fed S Hiking Cycle Ishares Blackrock

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

3 Things To Do Now After The Fed S Biggest Interest Rate Hike In Almost 30 Years

The Fed Hikes Up Interest Rates In An Effort To Curb Inflation Wzzm13 Com

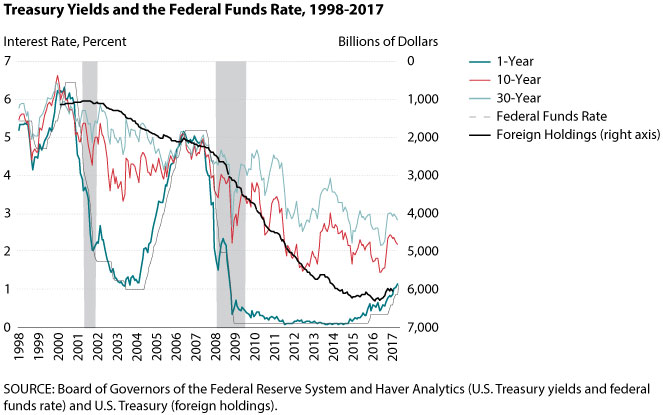

The Rising Federal Funds Rate In The Current Low Long Term Interest Rate Environment St Louis Fed

September Jobs Report Could Solidify Another Super Sized Fed Rate Hike Fox Business

Stock Market Outlook 2022 Fed Rate Hikes Wall Street Forecasts

What History Tells Us About This Week S Fed Interest Rate Hike

Tight Rope History S Lessons About Rate Hike Cycles Charles Schwab

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Fed Rate Hikes Expectations And Reality Benzinga

Why One Expert Predicts More Rate Hikes Before Inflation Slows And How To Prepare Nextadvisor With Time