net investment income tax 2021 trusts

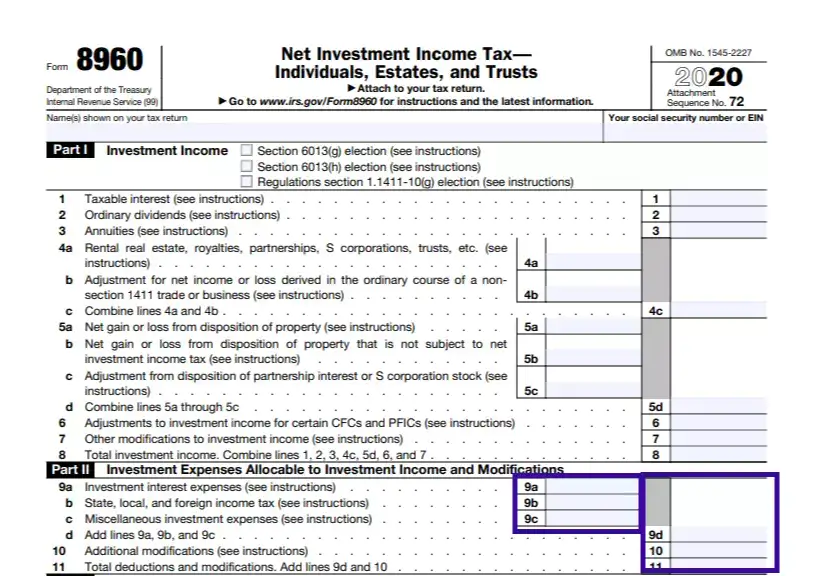

Subject to a 38 unearned income. Go to wwwirsgovForm8960 for instructions and the latest information.

Affordable Care Act Tax Law Changes For Higher Income Taxpayers Taxact Blog

The threshold amount for the 2021 tax year is 13050.

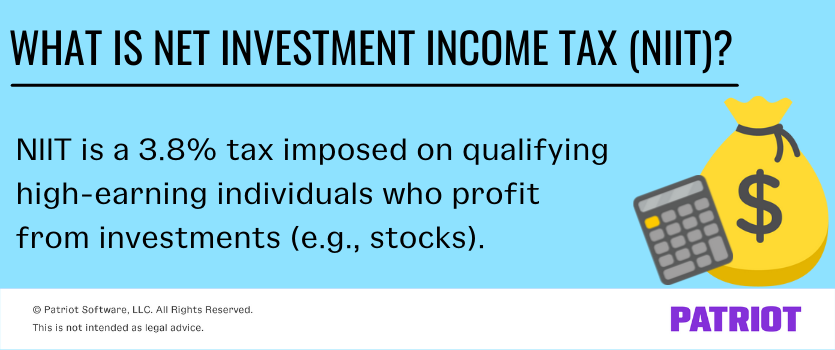

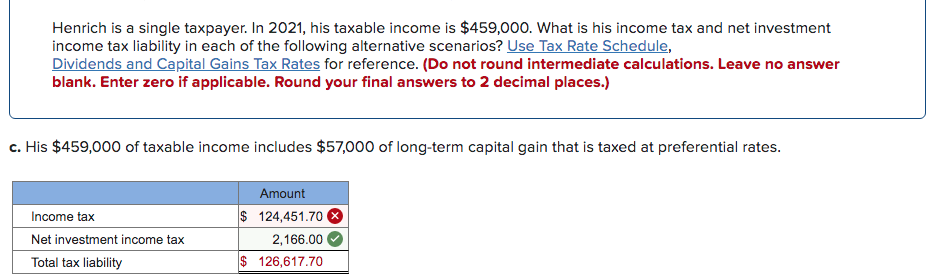

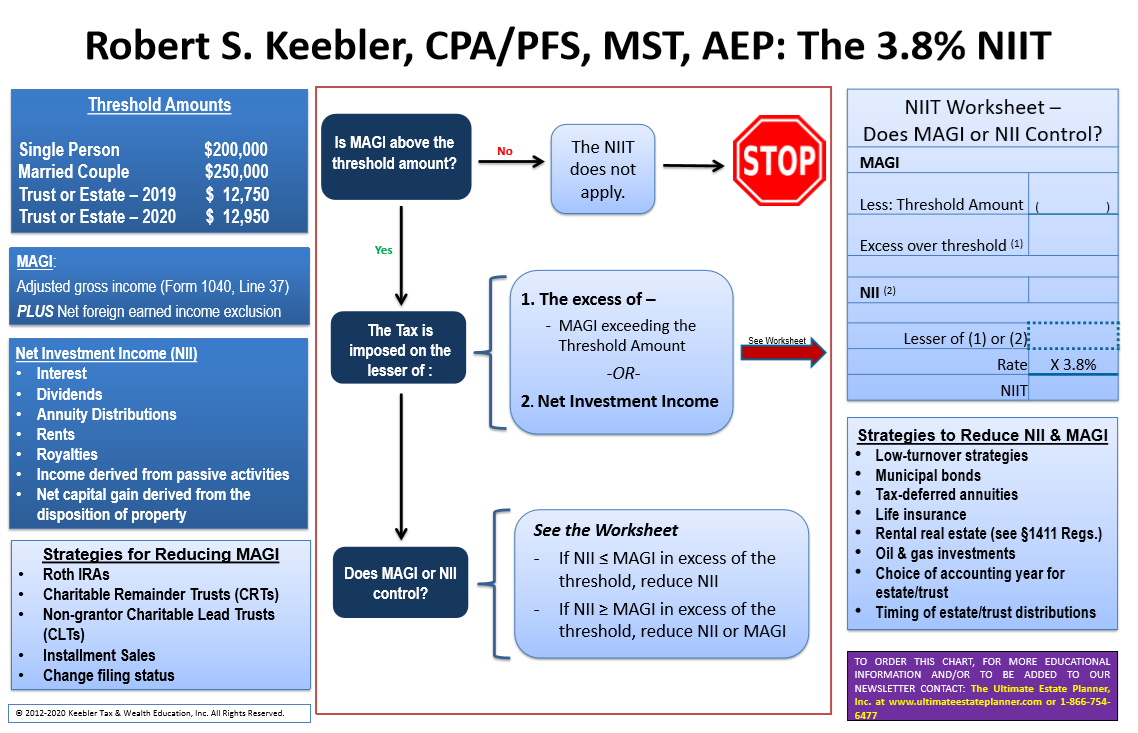

. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. The Net Investment Income Tax is just one layer of ta x imposed on undistributed trust and estate income. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

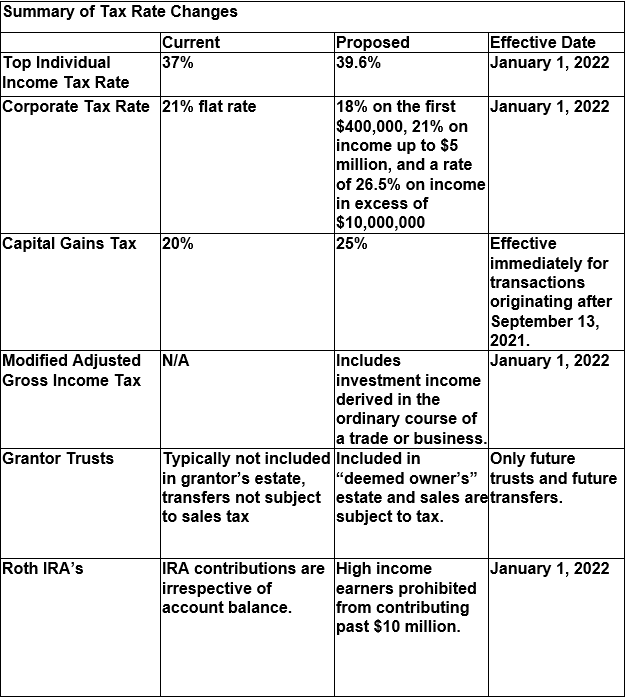

Federal income tax is imposed on trusts and estates at the rate of. When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that went into effect for this. Therefore the QFT has two beneficiary contracts with net investment income in excess of the threshold amount for the year.

Federal Realty Investment Trust NYSEFRT today reported operating results for its first quarter ended March 31 2022. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The estates or trusts portion of net.

The 38 Net Investment Income Tax. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. The NIIT is contained in Section 1411 of the Internal Revenue Code and applies a tax rate of 38 percent to the net investment income of individuals estates and trusts that.

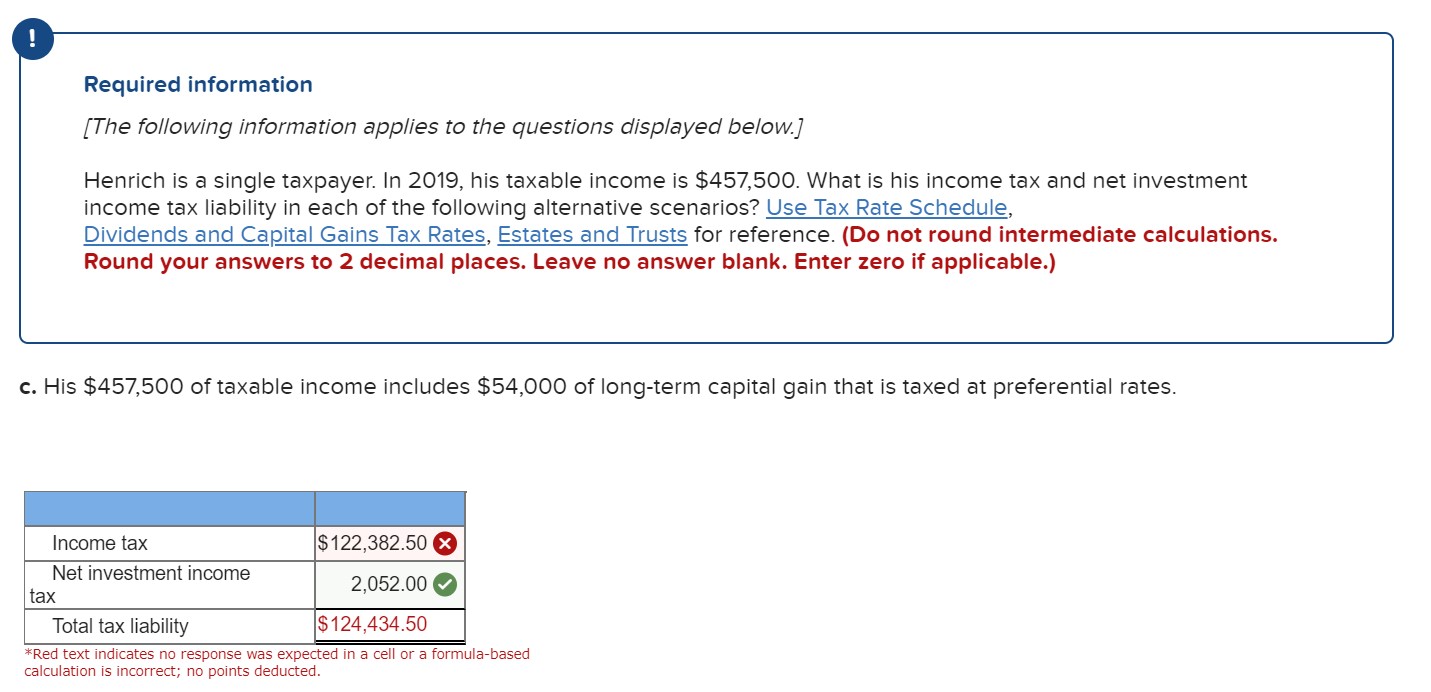

Since 2013 certain higher-income individuals have been. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the magi threshold only 13050 for. Trusts 60000 of taxable income attributable to the IRA is excluded from net investment income.

1 day agoThe Company invites stockholders prospective stockholders and analysts to participate in MITTs first quarter earnings conference call on May 6 2022 at 830 am Eastern. Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021.

We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Estates and Trusts are subject to NIIT if they have undistributed net investment income and also have adjusted gross income over the dollar amount at which the highest tax.

Generally net investment income includes gross income from interest dividends annuities and royalties. Share on Twitter. For the three months ended March 31 2022 and 2021.

The 38 Net Investment Income Tax under Internal Revenue Code Section 1411 would be broadened to include any income derived in the ordinary course of business for single. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level. All About the Net Investment Income Tax.

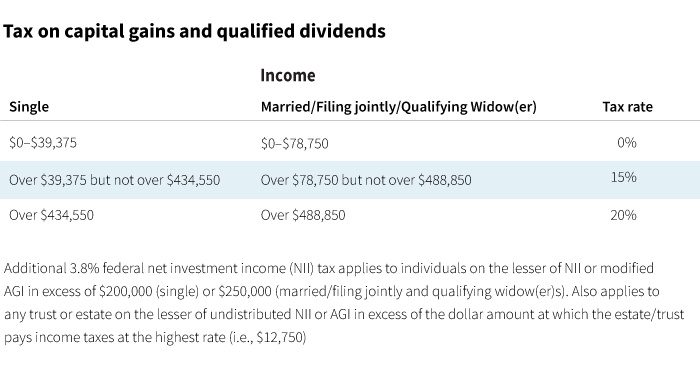

More about the Federal Form 8960 Other TY 2021. Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends. Trusts undistributed net investment income is 25000 which is Trusts net.

Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. This tax only applies to high-income.

For tax year 2015 the highest regular income tax bracket for trusts and estates 396 percent begins with taxable income in excess of 12300. A Team Exclusively Focused on Tax Filing and Legacy Planning for UHNW and HNW. Form 1041 - Net Investment Income.

Net Investment Income Tax For 1040 Filers Perkins Co

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

What Is The Net Investment Income Tax Caras Shulman

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Answered Required Information The Following Bartleby

Congress Readies New Round Of Tax Increases

How To Calculate The Net Investment Income Properly

What Is Net Investment Income Tax Overview Of The 3 8 Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Applying The New Net Investment Income Tax To Trusts And Estates

Irs Form 8960 Fill Out Printable Pdf Forms Online

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

How To Calculate The Net Investment Income Properly

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

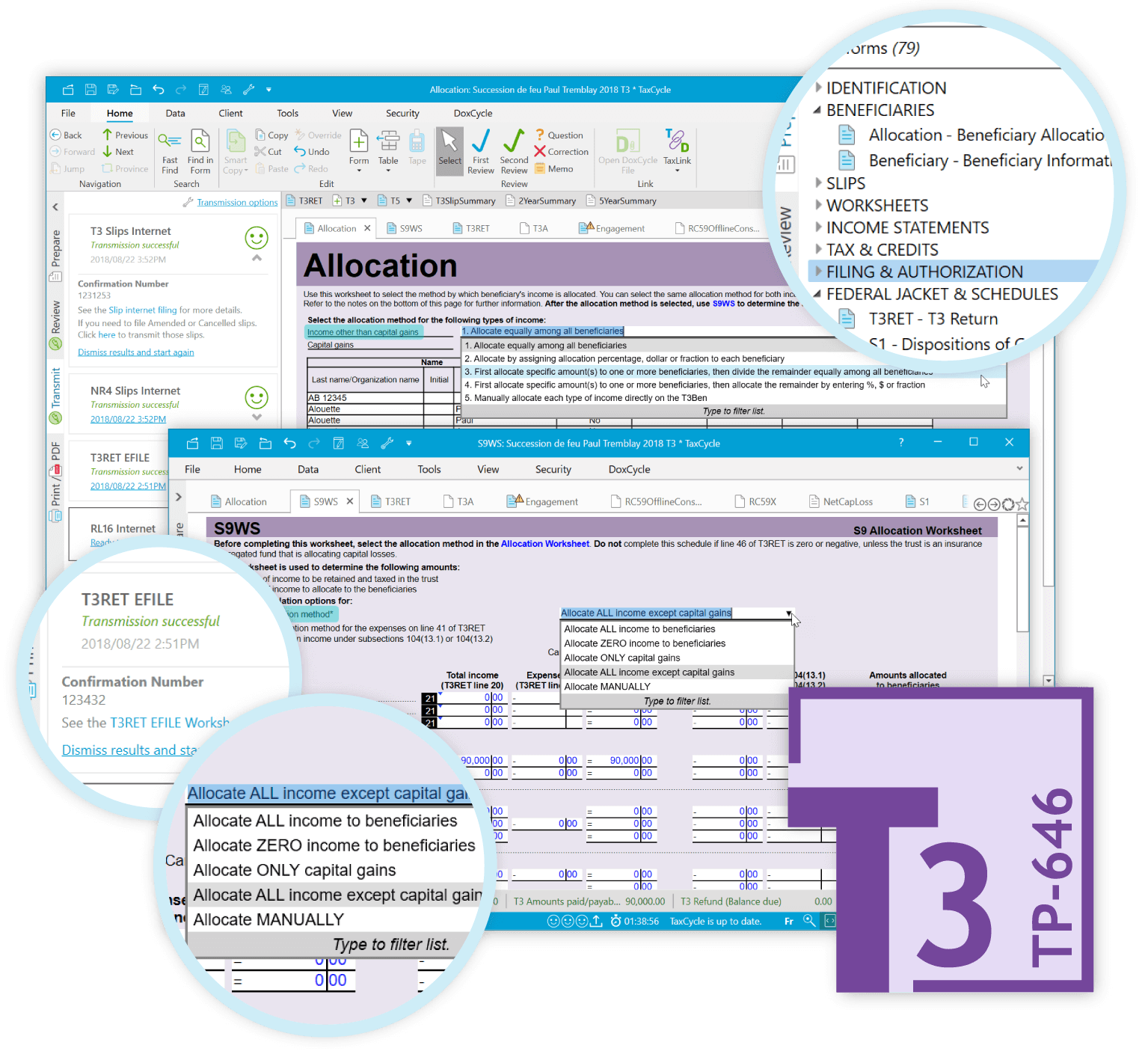

Taxcycle T3 Trust Returns Taxcycle

Gauge Your Tax Bracket To Drive Tax Planning At Year End

What Is The The Net Investment Income Tax Niit Forbes Advisor